Buying an RV is exciting. Whether it’s a motorhome for cross-country trips or a travel trailer for weekend escapes, the freedom is real. But before the road trips begin, most people face the same practical question: how much will this RV actually cost me every month?

That’s exactly where an RV loan calculator comes in.

I’ve helped friends, family members, and clients plan RV purchases over the years, and one lesson always repeats itself: people underestimate how much loan terms, interest rates, and down payments affect the final cost. An RV loan calculator removes guesswork and replaces it with clarity.

In this guide, I’ll walk you through what an RV loan calculator is, how it works, how to use it properly, and what the numbers really mean—without sales talk, pressure, or confusing finance jargon.

What Is an RV Loan Calculator?

An RV loan calculator is a simple financial tool that helps you estimate:

- Your monthly RV loan payment

- The total interest you’ll pay over time

- The total cost of the RV loan

You enter a few basic details—like RV price, interest rate, loan term, and down payment—and the calculator shows you realistic payment estimates.

It’s designed for planning and understanding, not applying for a loan. That’s why the search intent behind “rv loan calculator” is primarily informational. People want answers, not pitches.

Why Use an RV Loan Calculator Before Buying?

From experience, here’s why this tool matters more than most people think:

- RV loans often have longer terms than car loans

- Small interest rate changes can add thousands of dollars over time

- Monthly payments can look affordable while total cost quietly balloons

An RV loan calculator helps you:

- Set a realistic budget

- Compare different loan terms

- Avoid financial regret later

How an RV Loan Calculator Works

Key Inputs You’ll Enter

Most RV loan calculators ask for the same core details:

1. RV Purchase Price

The total cost of the RV before any down payment.

2. Down Payment

Money you pay upfront. This reduces the loan amount and usually lowers interest costs.

3. Interest Rate (APR)

The annual percentage rate charged by the lender.

4. Loan Term

The length of the loan—commonly 5, 10, 15, or even 20 years for RVs.

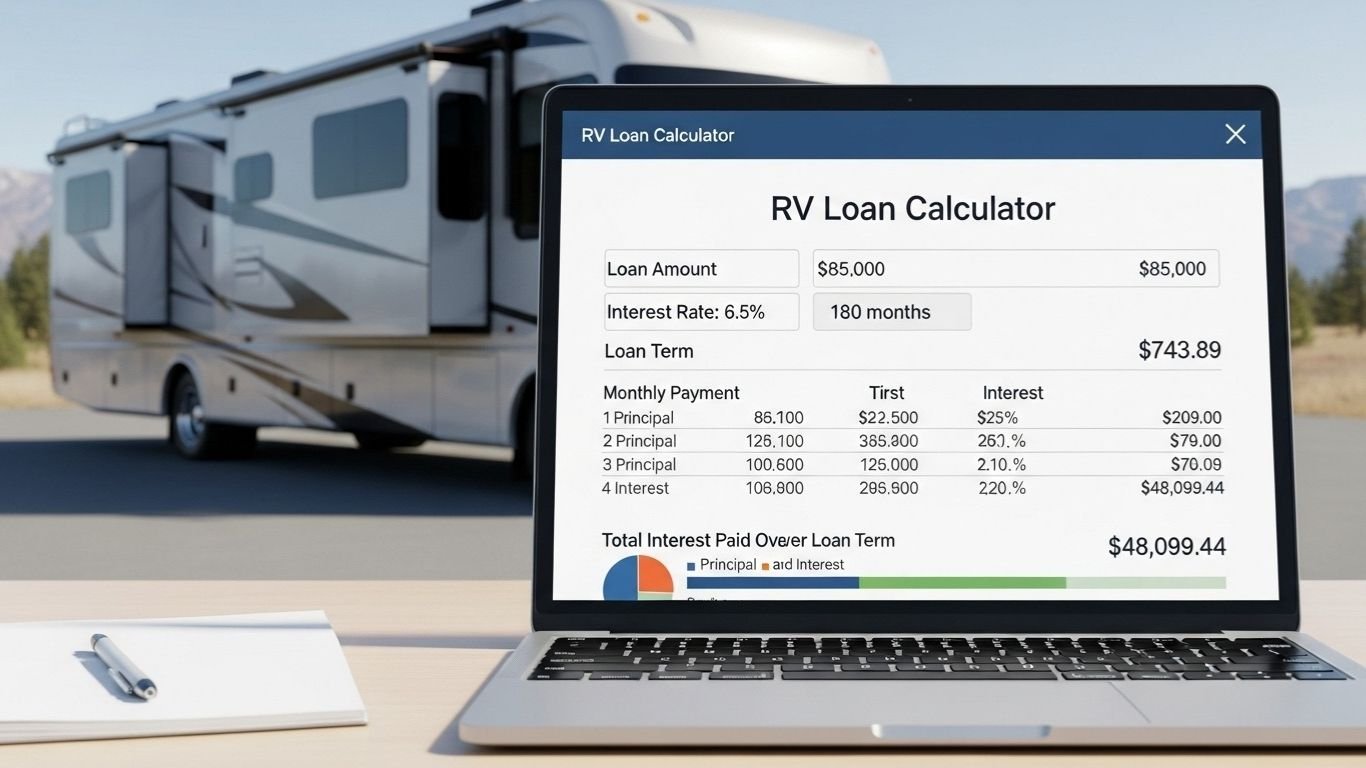

What the Calculator Shows You

Once you enter the numbers, you’ll typically see:

- Estimated monthly payment

- Total interest paid

- Total loan cost

Some calculators also include an amortization schedule, which breaks down how much of each payment goes toward interest vs. principal.

Example: Using an RV Loan Calculator in Real Life

Let’s say you’re considering:

- RV price: $60,000

- Down payment: $10,000

- Loan amount: $50,000

- Interest rate: 8%

- Loan term: 15 years

An RV loan calculator would show:

- Monthly payment: roughly $480

- Total interest paid: over $36,000

- Total loan cost: around $86,000

This is where many buyers pause. The monthly payment seems manageable—but the total interest nearly matches the original RV price.

That’s the kind of insight calculators are meant to reveal.

Understanding RV Loan Terms (Without the Confusion)

RV Loan Lengths Are Different From Car Loans

RV loans often run longer than standard auto loans because RVs are expensive and not daily drivers.

Common RV loan terms:

- 5–7 years (higher payment, less interest)

- 10–15 years (most common)

- 20 years (lowest monthly payment, highest interest)

Longer terms reduce monthly payments—but increase total cost.

Interest Rates: What Affects Them?

Based on real-world lending patterns, RV loan interest rates depend on:

- Credit score

- New vs. used RV

- RV type (motorhome vs trailer)

- Loan amount

- Loan term length

An RV loan calculator lets you test different interest rates so you’re not relying on best-case assumptions.

What an RV Loan Calculator Does Not Include

This is important, and many guides skip it.

An RV loan calculator usually does not include:

- Sales tax

- Registration fees

- Insurance costs

- Maintenance and repairs

- Storage fees

- Extended warranties

These costs don’t affect the loan payment directly, but they absolutely affect affordability. Always consider them separately.

RV Loan Calculator vs Auto Loan Calculator

People often ask if they can just use a car loan calculator. Technically, yes—but it’s not ideal.

Key differences:

- RV loan terms are longer

- Interest rates are often higher

- RV depreciation works differently

An RV-specific loan calculator reflects these realities better.

How to Use an RV Loan Calculator Smartly

Here’s how I recommend using one:

- Start with conservative numbers

Use a realistic interest rate—not the lowest you’ve seen online. - Compare multiple loan terms

Look at 10, 15, and 20 years side by side. - Adjust the down payment

Even small increases can significantly reduce interest. - Focus on total cost, not just monthly payment

This approach helps avoid emotional decisions.

RV Loan Affordability: A Reality Check

A calculator gives numbers, but judgment matters too.

Ask yourself:

- Can I afford this payment if income drops?

- Am I comfortable paying this much interest?

- Will I still want this RV in 10–15 years?

An RV loan calculator supports smarter decisions—but it doesn’t replace honest self-assessment.

Frequently Asked Questions About RV Loan Calculators

Can I use an RV loan calculator with bad credit?

Yes. Simply enter a higher interest rate to see realistic payment estimates.

Do RV loan calculators include taxes?

Most do not. You’ll need to estimate taxes separately.

Are RV loan terms really as long as 20 years?

Yes, especially for expensive motorhomes. But longer terms mean more interest.

Is a down payment required for RV loans?

Not always, but a down payment usually lowers interest rates and monthly payments.

How accurate is an RV loan calculator?

It’s an estimate—not a guarantee—but it’s accurate enough for planning and comparison.

Final Thoughts: Why an RV Loan Calculator Is Worth Using

An RV loan calculator isn’t about killing the dream of RV ownership. It’s about protecting it.

When you understand:

- How loan terms change total cost

- How interest adds up over time

- What “affordable” really means

You’re far more likely to enjoy your RV without financial stress following you down the highway.

If you’re serious about buying an RV, using an RV loan calculator should be one of the very first steps—not the last.