Buying a boat is exciting, but the financing part can feel confusing fast. Interest rates, loan terms, down payments, taxes, everything affects what you’ll actually pay each month. That’s where a boat loan calculator becomes essential.

If you’re even thinking about financing a boat, this tool helps you understand the numbers before you talk to a lender. In this guide, I’ll walk you through how a boat loan calculator works, why it matters, and how to use it realistically, based on real-world experience and how lenders actually structure boat loans.

No sales pitch. No pressure. Just clear, practical information.

What Is a Boat Loan Calculator?

A boat loan calculator is an online tool that estimates how much your boat loan may cost over time. It shows:

- Your estimated monthly payment

- The total interest you’ll pay

- The overall cost of the loan

You enter a few basic details, and the calculator does the math instantly. While it doesn’t replace a lender’s official quote, it gives you a reliable financial snapshot so you can plan realistically.

Why a Boat Loan Calculator Is So Important

From experience, most people focus on the boat price, not the loan cost. That’s a mistake.

A calculator helps you:

- Avoid taking on a payment you’ll regret

- Compare different loan terms before applying

- Understand how interest quietly increases total cost

- Adjust down payment or loan length to fit your budget

Even a small change, like one extra year on the loan, can add thousands in interest. Seeing that upfront changes decisions quickly.

How a Boat Loan Calculator Works (In Simple Terms)

Most boat financing calculators use a standard loan amortization formula. You don’t need to understand the math, just what each input means.

Common Inputs You’ll See

Boat Price

The total purchase price of the boat, including optional upgrades if financed.

Down Payment

The amount you pay upfront. Larger down payments usually mean:

- Lower monthly payments

- Less interest over time

- Better loan approval chances

Interest Rate (APR)

This is the annual percentage rate charged by the lender. Boat loan rates often depend on:

- Credit score

- Boat age

- Loan length

Loan Term

The length of the loan, usually between 5 and 20 years. Longer terms lower monthly payments but increase total interest.

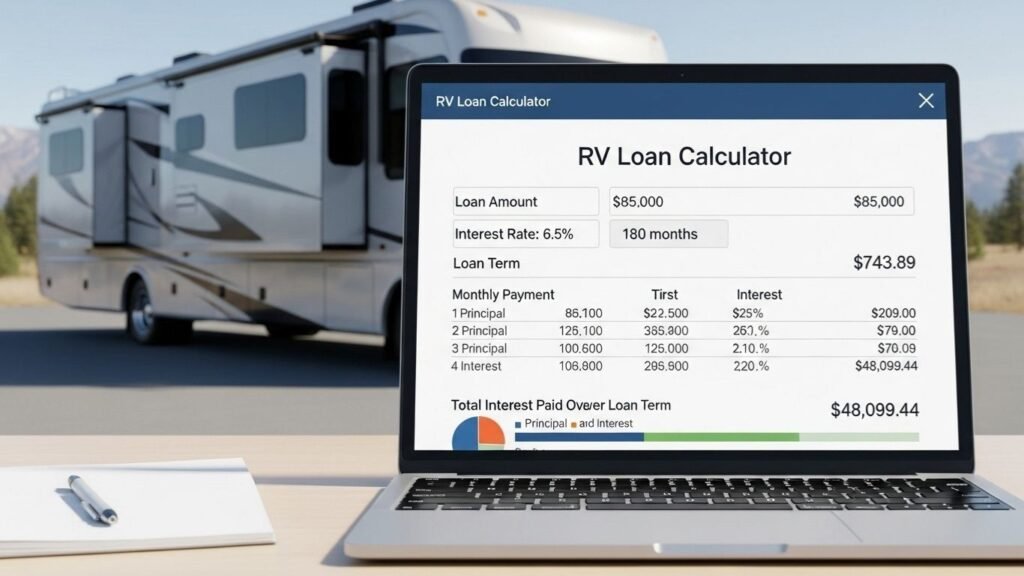

What Results the Calculator Shows

Once you enter the details, a boat loan calculator typically displays:

- Estimated monthly payment

- Total interest paid

- Total loan cost

- Sometimes an amortization breakdown

This lets you answer the most important question:

Can I comfortably afford this boat long-term?

Real-World Example: Why the Calculator Matters

Let’s say:

- Boat price: $50,000

- Down payment: $5,000

- Interest rate: 7%

- Loan term: 15 years

Your monthly payment may seem manageable. But when you look at the calculator output, you’ll likely notice that total interest adds tens of thousands over the loan’s life.

Shortening the term to 10 years might raise your payment slightly, but save you a significant amount overall. This is exactly the kind of insight a calculator provides before any commitment.

Key Factors That Affect Boat Loan Calculations

Credit Score

Higher credit scores usually mean:

- Lower interest rates

- Better loan terms

- More lender options

Boat Age and Type

Newer boats often qualify for better financing. Older boats or specialty vessels may carry higher rates or shorter loan terms.

Loan Length

Longer loans reduce monthly payments but increase interest. Shorter loans do the opposite.

Taxes and Fees

Many calculators don’t automatically include:

- Sales tax

- Registration fees

- Documentation costs

You should mentally add these when estimating affordability.

Boat Loan Calculator vs Actual Loan Offers

It’s important to be realistic. A boat loan calculator provides estimates, not guarantees.

Differences may occur due to:

- Your final credit approval

- Lender-specific fees

- Market rate changes

- Insurance or collateral requirements

Still, calculators are accurate enough to guide decisions, which is their main purpose.

How to Use a Boat Loan Calculator Wisely

Here’s how experienced buyers use these tools effectively:

- Run multiple scenarios (different down payments and terms)

- Don’t max out your budget

- Focus on total loan cost, not just monthly payment

- Leave room for ownership expenses like fuel, storage, and maintenance

- Use conservative interest estimates if you’re unsure

Think of the calculator as a planning tool, not a promise.

Boat Loan Calculator vs Personal Loan Calculator

Boat loans are usually secured loans, meaning the boat itself is collateral. This often results in lower rates compared to personal loans.

A general loan calculator can work, but a boat financing calculator is more accurate because it reflects:

- Longer loan terms

- Marine lending standards

- Boat-specific risk factors

Common Mistakes People Make

Based on experience, these come up often:

- Ignoring interest over time

- Choosing the longest loan possible without considering total cost

- Forgetting insurance and maintenance costs

- Relying on a single scenario instead of comparisons

A good calculator helps avoid all of these, if you use it honestly.

Frequently Asked Questions (People Also Ask)

What is a good interest rate for a boat loan?

Rates vary, but strong credit borrowers may see lower rates, while others may pay more depending on loan length and boat age.

How much down payment is usually required?

Many lenders expect 10% to 20%, though requirements vary based on credit and loan size.

Can I use a boat loan calculator with bad credit?

Yes. You can estimate payments using higher interest rates to get a realistic idea of affordability.

Are boat loan calculators accurate?

They’re accurate for estimates, but final loan terms depend on lender approval and individual financial details.

Do boat loan calculators include taxes?

Most do not. Always factor in taxes and fees separately.

EEAT Insight: What Experienced Buyers Know

After seeing many boat purchases, one truth stands out:

The calculator doesn’t lie, optimism does.

People who use a boat loan calculator early tend to:

- Borrow less

- Choose better loan terms

- Enjoy ownership without financial stress

That’s why lenders use the same math behind the scenes.

Final Thoughts: Is a Boat Loan Calculator Worth Using?

Absolutely.

A boat loan calculator isn’t about stopping you from buying a boat, it’s about helping you buy one confidently and responsibly.

It gives clarity before paperwork, before pressure, and before long-term commitments. If you’re serious about boat ownership, using a calculator is one of the smartest first steps you can take.