Navigating the world of payment processing can be tricky, especially if your business is labeled “high-risk.” Finding a reliable partner is crucial, and you’ve likely come across HighRiskPay.com in your search. This guide breaks down everything you need to know about getting a high-risk merchant account at HighRiskPay.com, from the application process to managing your account long-term.

We’ll look at the features, the application steps, and what sets them apart. The goal is to give you a clear, straightforward understanding so you can decide if it’s the right fit for your business.

What Exactly Is a High-Risk Merchant Account?

First, let’s clarify what “high-risk” means in this context. It’s not a judgment on your business’s quality or legitimacy. Instead, it’s a classification used by payment processors and banks for industries that have a higher likelihood of chargebacks, fraud, or regulatory oversight.

Industries that often require a high-risk merchant account include:

- CBD and vape products

- Subscription and continuity services

- Adult entertainment

- Travel and ticketing agencies

- Credit repair services

- Online gaming and casinos

- Nutraceuticals

If your business falls into one of these categories, standard payment processors like Stripe or PayPal might not approve you. They tend to avoid the financial liability associated with these industries. A high-risk merchant account is a specialized service designed to provide stable payment processing for these businesses.

Why Consider HighRiskPay.com for Your Merchant Account?

When you’re looking for a high-risk processor, you want a provider that understands the unique challenges you face. HighRiskPay.com specializes in this area, offering solutions tailored to businesses that have been turned away elsewhere.

Based on my experience, their key strengths lie in their approval process and specialized features. They advertise a 99% approval rate, which is a significant draw for merchants who have struggled to find a processor. They also emphasize having no setup or application fees, which removes a common barrier to entry.

Other standout features include a fast approval timeline, often within 24 to 48 hours, and built-in tools for chargeback prevention. For a high-risk business, minimizing disputes is essential for long-term account stability, so these tools are incredibly valuable.

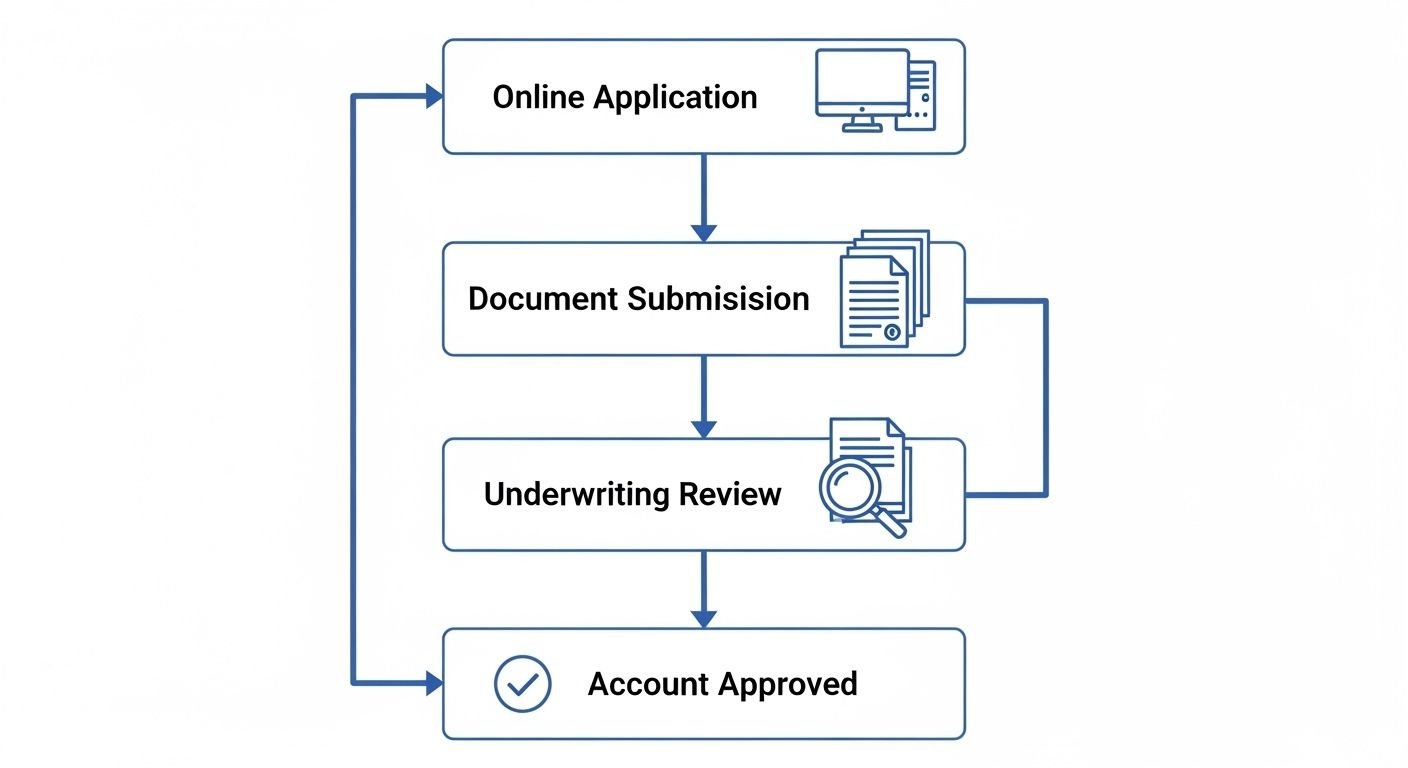

A Step-by-Step Guide to Applying for an Account

The application process for a high-risk merchant account is more involved than for a standard one, but it doesn’t have to be complicated. Here’s a look at the typical steps when applying at HighRiskPay.com.

Step 1: The Initial Online Form

It starts with a simple intake form on their website. You’ll provide basic details about your business: your name, contact information, website URL, and estimated monthly processing volume. Be as accurate as possible here, as this information forms the basis of your application. Any inconsistencies can cause delays later on.

Step 2: Submitting Your Documents

After the initial form, a representative will likely contact you to request supporting documents. This is the core of the underwriting process. Having these documents ready can significantly speed things up.

Essential documents usually include:

- A valid, government-issued ID (like a driver’s license or passport).

- A voided check or a bank letter for the business bank account.

- Your business license or articles of incorporation.

- Three to six months of recent business bank statements.

- If you’ve processed payments before, three months of your most recent processing statements.

Step 3: Underwriting and Approval

Once you’ve submitted your documents, your file goes to the underwriting team. They review everything to assess the risk associated with your business. They look at your industry, financial stability, and processing history.

For a high-risk business, this stage is critical. The underwriters are trying to build a complete picture of your operations. If they have questions, they will reach out. Responding quickly and thoroughly is key to a smooth approval. The typical timeline is 24 to 48 hours, but complex cases can take a bit longer.

Key Features and Benefits to Look For

A high-risk merchant account is more than just a way to accept payments. The right provider offers tools to help you protect and grow your business.

Fraud Prevention and Chargeback Management

HighRiskPay.com offers tools designed to help you manage chargebacks and prevent fraud. These systems monitor transactions for suspicious activity and can alert you to potential issues. Effective chargeback management is non-negotiable for a high-risk business, as high dispute rates can lead to account termination.

Flexible Payment Processing Options

Your customers expect convenient ways to pay. A good high-risk account should allow you to accept all major credit cards. Many providers, including HighRiskPay.com, also offer processing for ACH transfers and eChecks, which can be great alternatives for certain business models.

Competitive Rates and Fees

Fees for high-risk accounts are generally higher than for standard accounts. That’s just the nature of the industry. However, the pricing should be transparent. HighRiskPay.com states they do not have hidden fees and their rates are competitive. Always make sure you understand the entire fee structure, including transaction rates, monthly fees, and chargeback fees, before signing an agreement.

HighRiskPay.com vs. Competitors

It’s always wise to compare your options. One common alternative you might see is Merchantech. Both specialize in high-risk processing, but there are differences.

Some users report that providers like Merchantech offer dedicated account managers, which can be a plus for personalized service. HighRiskPay.com focuses on a streamlined, fast approval process and a high acceptance rate. The best choice depends on your priorities. Do you value speed and a high likelihood of approval, or is having a dedicated contact person more important?

Ultimately, the key is to find a provider whose expertise aligns with your specific industry. A processor with deep experience in the CBD space, for example, will be better equipped to handle the unique compliance needs of a CBD business than a generalist high-risk provider.

Frequently Asked Questions (FAQs)

Here are answers to some of the most common questions merchants have about getting a high-risk merchant account.

What documents do I need to apply?

You will typically need a government-issued ID, a voided check or bank letter, your business license, and several months of business bank and processing statements (if applicable).

How long does the approval process take?

For providers like HighRiskPay.com, approval usually takes 24 to 48 hours. This can be longer if your application is complex or if documents are missing.

Can I get an account with bad credit?

Yes, it’s often possible. High-risk processors understand that personal credit isn’t the only indicator of a business’s health. They look at your overall business profile, including your industry and financial history. Many providers, including HighRiskPay.com, explicitly state they work with merchants who have poor credit.

What happens if my application is denied?

A denial isn’t necessarily the end of the road. The processor will usually provide a reason. Common reasons include being in a prohibited industry (even for a high-risk provider) or having incomplete documentation. You can often resolve the issue and reapply.

Tips for Managing Your High-Risk Account

Getting approved is just the first step. To maintain a healthy, long-term processing relationship, you need to manage your account proactively.

Prioritize Chargeback Prevention

Keep your chargeback ratio as low as possible. Use clear billing descriptors so customers recognize the charge on their statements. Provide excellent customer service and make your refund policy easy to find. This encourages customers to contact you directly instead of initiating a chargeback.

Monitor for Fraud

Use the fraud prevention tools your processor provides. Be vigilant for suspicious transaction patterns, such as multiple orders from the same IP address with different credit cards.

Stay Compliant

High-risk industries often have strict regulations. Stay up-to-date on the rules for your industry to avoid any compliance issues that could put your account at risk.

Final Thoughts

Securing a high-risk merchant account at HighRiskPay.com or a similar provider is an essential step for many businesses. The process requires more documentation and scrutiny, but a specialized processor understands your needs and can provide a stable solution.

The key is to be prepared. Have your documents in order, be transparent about your business model, and choose a partner with proven experience in your industry. By doing so, you can set your business up with the reliable payment processing it needs to succeed.